Simple Moving Average

Contents

Simple Moving Average#

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

Load Data#

Consider the Tesla stock of the latest 90 days.

stocks: pd.DataFrame = pd.read_csv("../../data/stocks.csv", index_col=0, parse_dates=True)

company = "TSLA"

stock = stocks.query(f"Company == '{company}'").drop(columns=["Company", "Sector"])

stock_price = stock[["Close"]]

stock_price

| Close | |

|---|---|

| Date | |

| 2017-11-02 | 19.950666 |

| 2017-11-03 | 20.406000 |

| 2017-11-06 | 20.185333 |

| 2017-11-07 | 20.403334 |

| 2017-11-08 | 20.292667 |

| ... | ... |

| 2022-10-26 | 224.639999 |

| 2022-10-27 | 225.089996 |

| 2022-10-28 | 228.520004 |

| 2022-10-31 | 227.539993 |

| 2022-11-01 | 227.820007 |

1258 rows × 1 columns

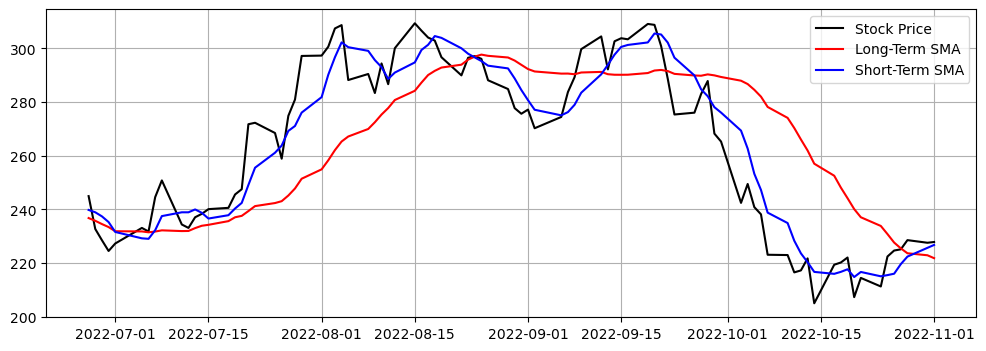

Long and Short-Term Simple Moving Averages#

For each day, we need to compute the average stock price within a period of time before that day. To do so, we need to slide a fixed length window (hence the name moving average) along the times series and compute the mean value of the prices falling into the window. Panda’s DataFrame (or Series) has a method rolling, which can achieve this easily.

In this notebook, we assume the periods of the long and short-term SMA are 20 and 5, respectively. We now compute the moving averages:

long_period = 20

short_period = 5

long = stock_price.rolling(long_period).mean()

short = stock_price.rolling(short_period).mean()

# plot stock price, long-term SMA and short-term SMA of the last 90 days

num_days = 90

plt.figure(figsize=(12, 4))

plt.plot(stock_price[-num_days:], label="Stock Price", color="k")

plt.plot(long[-num_days:], label="Long-Term SMA", color="r")

plt.plot(short[-num_days:], label="Short-Term SMA", color="b")

plt.legend()

plt.grid()

plt.show()

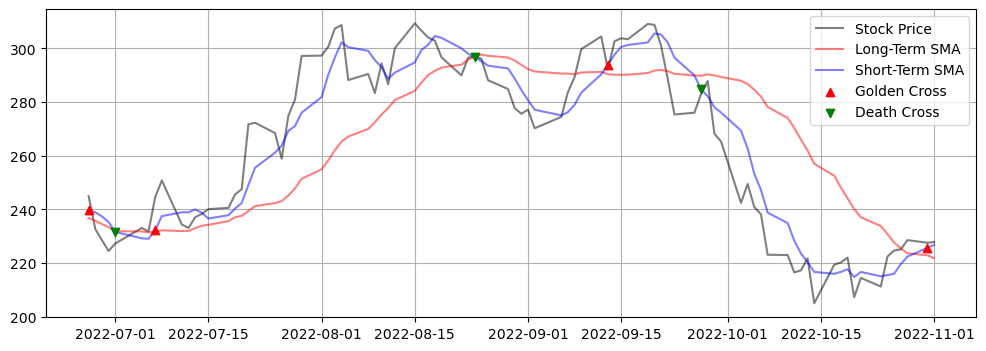

Golden Cross vs. Death Cross#

The golden cross

appears when the short-term MA crosses up through the long-term MA, and

it indicates a signal to buy.

The death cross

appears when the short-term MA crosses trends down and crosses the long-term MA, and

it indicates a signal to sell.

We can use bitwise operations to find golden and death crosses. By definition, we note that a golden cross occurs when

short-term MA > long-term MA on current day, and

short-term MA < long-term MA on the preceding day.

In code:

(short > long) & ((short < long).shift(1))

The death crosses can be found in the similar way.

golden = ((short > long) & ((short < long).shift(1))).query("Close == True").index

death = ((short < long) & ((short > long).shift(1))).query("Close == True").index

print(f"Golden cross: {golden}")

print(f"Death cross: {death}")

Golden cross: DatetimeIndex(['2017-12-11', '2018-01-11', '2018-02-22', '2018-04-11',

'2018-05-02', '2018-06-04', '2018-08-03', '2018-09-21',

'2018-10-25', '2018-11-30', '2019-01-10', '2019-02-11',

'2019-02-14', '2019-04-01', '2019-06-11', '2019-09-05',

'2019-10-01', '2019-10-11', '2019-12-12', '2020-04-07',

'2020-08-14', '2020-09-17', '2020-09-30', '2020-11-09',

'2020-11-18', '2021-02-05', '2021-03-17', '2021-04-06',

'2021-05-28', '2021-06-10', '2021-07-30', '2021-08-26',

'2021-11-23', '2021-12-28', '2022-03-18', '2022-06-02',

'2022-06-27', '2022-07-07', '2022-09-13', '2022-10-31'],

dtype='datetime64[ns]', name='Date', freq=None)

Death cross: DatetimeIndex(['2017-12-04', '2017-12-28', '2018-02-06', '2018-03-07',

'2018-04-26', '2018-05-17', '2018-07-03', '2018-08-20',

'2018-10-04', '2018-11-26', '2018-12-20', '2019-01-23',

'2019-02-12', '2019-02-20', '2019-04-10', '2019-07-30',

'2019-09-26', '2019-10-04', '2019-11-27', '2020-02-28',

'2020-07-31', '2020-09-09', '2020-09-24', '2020-10-22',

'2020-11-12', '2021-02-03', '2021-02-10', '2021-03-22',

'2021-04-29', '2021-06-08', '2021-07-19', '2021-08-19',

'2021-11-15', '2021-12-06', '2022-01-18', '2022-04-13',

'2022-06-09', '2022-07-01', '2022-08-24', '2022-09-27'],

dtype='datetime64[ns]', name='Date', freq=None)

Plot the golden and death crosses:

Tip

For empty values, we use np.nan instead of pd.NA so that they will be ignored when plotting, which is as desired. Otherwise, an error will occur.

# the data frame `buy_sell_df` is just for plotting

# we don't need it for making decisions

buy_sell_df = stock_price.copy()

buy_sell_df["Buy"] = np.nan # use `np.nan` instead of `pd.NA`

buy_sell_df["Sell"] = np.nan

buy_sell_df.loc[golden, "Buy"] = short.loc[golden, "Close"]

buy_sell_df.loc[death, "Sell"] = short.loc[death, "Close"]

# plot the last 90 days

plt.figure(figsize=(12, 4))

plt.plot(stock_price[-num_days:], label="Stock Price", color="k", alpha=0.5)

plt.plot(long[-num_days:], label="Long-Term SMA", color="r", alpha=0.5)

plt.plot(short[-num_days:], label="Short-Term SMA", color="b", alpha=0.5)

plt.scatter(

buy_sell_df[-num_days:].index, buy_sell_df[-num_days:]["Buy"],

marker="^", color="r", zorder=2,

label="Golden Cross"

)

plt.scatter(

buy_sell_df[-num_days:].index, buy_sell_df[-num_days:]["Sell"],

marker="v", color="g", zorder=2,

label="Death Cross"

)

plt.legend()

plt.grid()

plt.show()

Profit#

Find the buying and selling dates starting from a given date, say 2022-06-27:

start_date = "2022-06-27"

buy_dates = golden[golden >= start_date]

sell_dates = death[death >= start_date]

# if we need to sell first, then ignore the first selling date

# since we don't have any shares

if buy_dates[0] > sell_dates[0]:

sell_dates = sell_dates[1:]

If you buy a certain amount of shares and then sell it later, then the percentage change is given by

buy = stock_price.loc[buy_dates, "Close"].to_numpy()

sell = stock_price.loc[sell_dates, "Close"].to_numpy()

# buying and selling dates should come in pairs

# except that there may be one more buying date in the end

assert len(buy) == len(sell) or len(buy) == len(sell) + 1

# don't buy

if len(buy) == len(sell) + 1:

buy = buy[:-1]

# an array of percentage profit

pct = (sell - buy) / buy

pct

array([-0.07209155, 0.21490402, -0.03145861])

In this case, the array of percentage changes only has one element since we have seen in the figure that we only need to buy and sell once.

Suppose that you investigate \(x\) dollars (capital principal), and you buy and sell \(n\) times. The percentage change of the \(i\)-th trade is denoted by \(p_i\). Then the final amount of money you will have is

Hence, the profit is

If you investigate 100 dollars, then you will gain:

# capital principal

capital = 100

# total amount

total = capital * np.prod(1 + pct)

# profit/gain

profit = total - capital

profit

9.185579844095642

Hence, the profit rate is:

print(f"Profit rate: {profit:.2f}%")

Profit rate: 9.19%