Visualization

Contents

Visualization#

import pandas as pd

import matplotlib.pyplot as plt

Load Data#

stocks = pd.read_csv("../../data/stocks.csv", index_col=0, parse_dates=True)

stocks

| Company | Sector | Open | High | Low | Close | Volume | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2017-11-02 | AAPL | Technology | 41.650002 | 42.125000 | 41.320000 | 42.027500 | 165573600 |

| 2017-11-03 | AAPL | Technology | 43.500000 | 43.564999 | 42.779999 | 43.125000 | 237594400 |

| 2017-11-06 | AAPL | Technology | 43.092499 | 43.747501 | 42.930000 | 43.562500 | 140105200 |

| 2017-11-07 | AAPL | Technology | 43.477501 | 43.812500 | 43.400002 | 43.702499 | 97446000 |

| 2017-11-08 | AAPL | Technology | 43.665001 | 44.060001 | 43.582500 | 44.060001 | 97638000 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 2022-10-26 | COP | Energy | 124.720001 | 128.179993 | 124.580002 | 126.570000 | 8139100 |

| 2022-10-27 | COP | Energy | 127.699997 | 129.449997 | 126.239998 | 126.639999 | 8948500 |

| 2022-10-28 | COP | Energy | 128.500000 | 128.990005 | 124.010002 | 127.169998 | 7293200 |

| 2022-10-31 | COP | Energy | 125.580002 | 129.990005 | 125.570000 | 126.089996 | 7121000 |

| 2022-11-01 | COP | Energy | 128.740005 | 129.320007 | 126.889999 | 127.779999 | 5874800 |

63377 rows × 7 columns

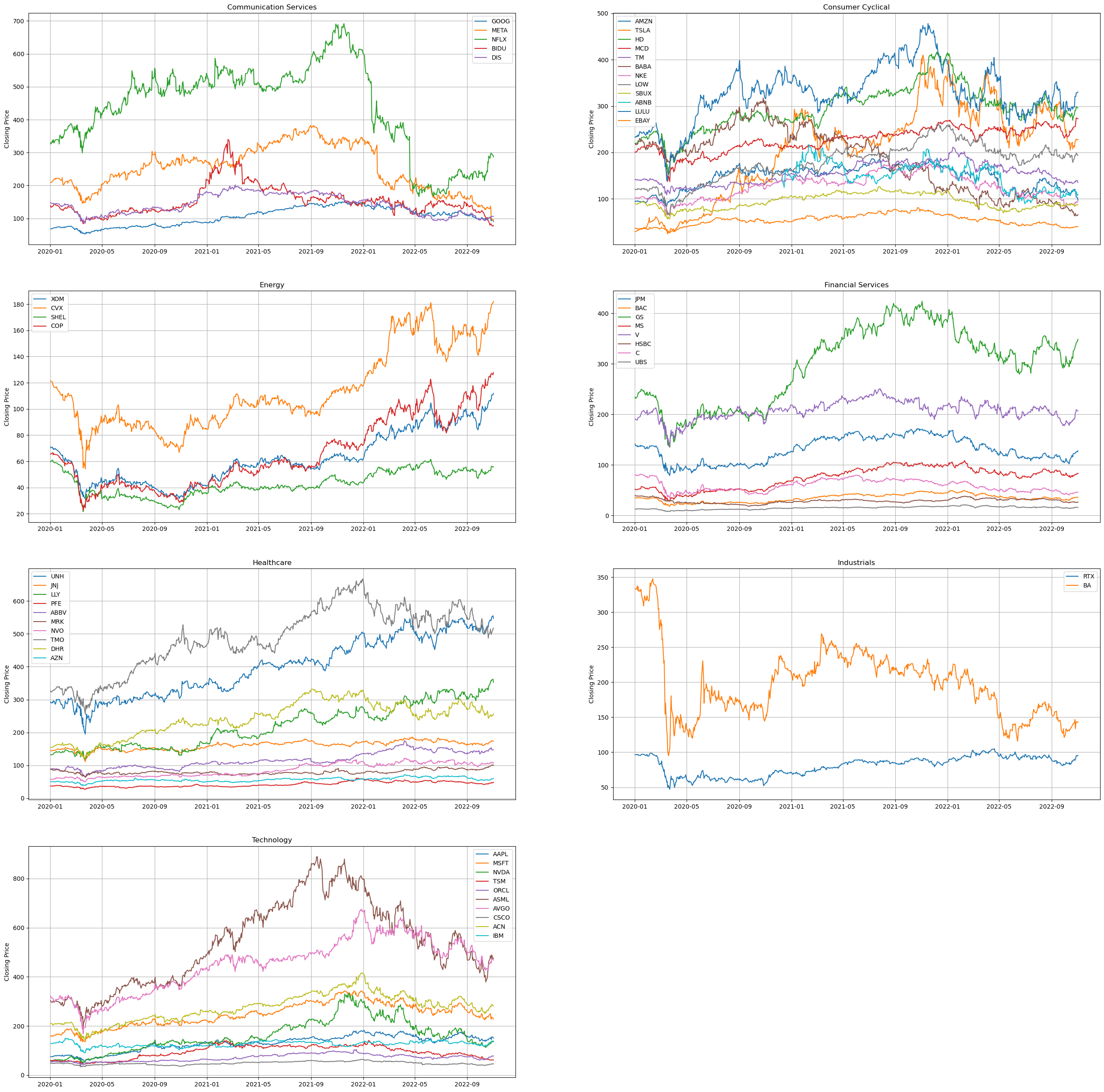

Trend of Closing Prices#

sectors = stocks["Sector"].unique()

sectors.sort()

sectors

array(['Communication Services', 'Consumer Cyclical', 'Energy',

'Financial Services', 'Healthcare', 'Industrials', 'Technology'],

dtype=object)

Function to plot stocks in a given sector:

def plot_closing_price(sector: pd.DataFrame, ax: plt.Axes):

df = stocks[stocks["Sector"] == sector]

df = df[df.index >= "2020-01-01"]

for company in df["Company"].unique():

closing_price = df[df["Company"] == company]["Close"]

ax.plot(closing_price, label=company)

ax.set_title(sector)

ax.set_ylabel("Closing Price")

ax.legend()

ax.grid()

Plot all sectors:

fig, axs = plt.subplots(4, 2, figsize=(32, 32))

axs = axs.flatten()

for i in range(7):

plot_closing_price(sectors[i], axs[i])

# delete the last empty axes

plt.delaxes(axs[7])

plt.show()

Evaluate Companies by Dollar Volumes#

The Dollar Volume can be computed by

\[

\text{Dollar Volume} = \text{Closing Price} \times \text{Volume}

\]

Find the company with maximum average dollar volume in each sector:

df = stocks.copy()

df["Dollar Volume"] = stocks["Close"] * stocks["Volume"]

df.groupby(["Company", "Sector"]).mean()\

.sort_values("Dollar Volume", ascending=False)\

.reset_index(level=(0, 1))\

.drop_duplicates(["Sector"])\

.set_index("Sector").sort_index()\

.drop(columns=["Open", "High", "Low"])

| Company | Close | Volume | Dollar Volume | |

|---|---|---|---|---|

| Sector | ||||

| Communication Services | META | 220.069316 | 2.337455e+07 | 4.929304e+09 |

| Consumer Cyclical | TSLA | 126.995117 | 1.317317e+08 | 1.306260e+10 |

| Energy | XOM | 68.636971 | 2.044632e+07 | 1.327712e+09 |

| Financial Services | BAC | 32.406224 | 5.806661e+07 | 1.825491e+09 |

| Healthcare | UNH | 332.375851 | 3.532888e+06 | 1.128240e+09 |

| Industrials | BA | 262.674833 | 1.174971e+07 | 2.541470e+09 |

| Technology | AAPL | 94.923971 | 1.178255e+08 | 1.039713e+10 |