Effective Portfolio

Contents

Effective Portfolio#

import numpy as np

import pandas as pd

import json

import matplotlib.pyplot as plt

Candidate Companies#

Recall that we have selected the most profitable company in each sector in the sense of dollar values. We now load the tickers of these candidate companies.

with open("../../data/companies.json", "r") as f:

companies: list[str] = json.load(f)

companies

['META', 'TSLA', 'XOM', 'BAC', 'UNH', 'BA', 'AAPL']

We then put the closing prices of these companies side by side in a data frame:

num_days = 90

# load data

stocks: pd.DataFrame = pd.read_csv("../../data/stocks.csv", index_col=0, parse_dates=True)

df_list = []

for company in companies:

df = stocks.query(f"Company == '{company}'")[["Close"]]

df.rename(columns={"Close": company}, inplace=True)

df_list.append(df)

# join stock prices of different companies

df = pd.DataFrame.join(df_list[0], df_list[1:])

# leave last 90 days out

df = df[:-num_days]

df

| META | TSLA | XOM | BAC | UNH | BA | AAPL | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2017-11-02 | 178.919998 | 19.950666 | 83.529999 | 27.870001 | 211.100006 | 262.630005 | 42.027500 |

| 2017-11-03 | 178.919998 | 20.406000 | 83.180000 | 27.820000 | 212.869995 | 261.750000 | 43.125000 |

| 2017-11-06 | 180.169998 | 20.185333 | 83.750000 | 27.750000 | 212.119995 | 264.070007 | 43.562500 |

| 2017-11-07 | 180.250000 | 20.403334 | 83.580002 | 27.180000 | 212.699997 | 266.130005 | 43.702499 |

| 2017-11-08 | 179.559998 | 20.292667 | 83.470001 | 26.790001 | 210.770004 | 265.570007 | 44.060001 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 2022-06-17 | 163.740005 | 216.759995 | 86.120003 | 31.920000 | 452.059998 | 136.800003 | 131.559998 |

| 2022-06-21 | 157.050003 | 237.036667 | 91.480003 | 32.849998 | 480.320007 | 136.750000 | 135.869995 |

| 2022-06-22 | 155.850006 | 236.086670 | 87.860001 | 32.599998 | 489.679993 | 137.160004 | 135.350006 |

| 2022-06-23 | 158.750000 | 235.070007 | 85.209999 | 32.080002 | 499.809998 | 133.970001 | 138.270004 |

| 2022-06-24 | 170.160004 | 245.706665 | 86.900002 | 32.310001 | 495.640015 | 141.529999 | 141.660004 |

1168 rows × 7 columns

Stock Returns#

A stock return is the change in price of an asset, investment, or project over time, which may be represented in terms of price change or percentage change. In fact, we have already introduced this concept when calculating the profit in a previous section.

Sometimes, it is preferred to use the log return:

# standard returns

stock_returns = df.pct_change().dropna()

# log returns

stock_returns = stock_returns.apply(lambda x : np.log(1 + x), axis=1)

stock_returns

| META | TSLA | XOM | BAC | UNH | BA | AAPL | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2017-11-03 | 0.000000 | 0.022566 | -0.004199 | -0.001796 | 0.008350 | -0.003356 | 0.025779 |

| 2017-11-06 | 0.006962 | -0.010873 | 0.006829 | -0.002519 | -0.003529 | 0.008824 | 0.010094 |

| 2017-11-07 | 0.000444 | 0.010742 | -0.002032 | -0.020754 | 0.002731 | 0.007771 | 0.003209 |

| 2017-11-08 | -0.003835 | -0.005439 | -0.001317 | -0.014453 | -0.009115 | -0.002106 | 0.008147 |

| 2017-11-09 | -0.001449 | -0.004610 | 0.005972 | -0.011261 | 0.003741 | -0.010866 | -0.002045 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 2022-06-17 | 0.017683 | 0.017029 | -0.059394 | 0.002195 | -0.008875 | 0.025468 | 0.011467 |

| 2022-06-21 | -0.041716 | 0.089424 | 0.060379 | 0.028719 | 0.060638 | -0.000366 | 0.032236 |

| 2022-06-22 | -0.007670 | -0.004016 | -0.040376 | -0.007639 | 0.019300 | 0.002994 | -0.003834 |

| 2022-06-23 | 0.018437 | -0.004316 | -0.030626 | -0.016079 | 0.020476 | -0.023532 | 0.021344 |

| 2022-06-24 | 0.069409 | 0.044255 | 0.019639 | 0.007144 | -0.008378 | 0.054896 | 0.024222 |

1167 rows × 7 columns

Volatility#

Suppose the proportion / weight of money we want to invest in each stock is \(w_i\). Then the volatility of the portfolio is given by

where \(\mathbf{w} = (w_1, \ldots, w_n)^\top\) (assuming there are \(n\) companies), and \(\Sigma\) is the covariance matrix of the daily stock returns, which can be computed by np.cov(stock_returns.T) or stock_returns.cov() since stock_returns is a DataFrame.

Covariance matrix of stock returns, \(\Sigma\):

Tip

It is recommended to use Pandas’ functions when experimenting if your data is a DataFrame since the output is somewhat nicer. While in actual production, NumPy is preferred.

stock_returns.cov()

| META | TSLA | XOM | BAC | UNH | BA | AAPL | |

|---|---|---|---|---|---|---|---|

| META | 0.000664 | 0.000371 | 0.000139 | 0.000207 | 0.000169 | 0.000284 | 0.000311 |

| TSLA | 0.000371 | 0.001678 | 0.000181 | 0.000260 | 0.000193 | 0.000457 | 0.000396 |

| XOM | 0.000139 | 0.000181 | 0.000449 | 0.000303 | 0.000172 | 0.000371 | 0.000154 |

| BAC | 0.000207 | 0.000260 | 0.000303 | 0.000500 | 0.000216 | 0.000436 | 0.000217 |

| UNH | 0.000169 | 0.000193 | 0.000172 | 0.000216 | 0.000362 | 0.000254 | 0.000198 |

| BA | 0.000284 | 0.000457 | 0.000371 | 0.000436 | 0.000254 | 0.001041 | 0.000295 |

| AAPL | 0.000311 | 0.000396 | 0.000154 | 0.000217 | 0.000198 | 0.000295 | 0.000429 |

Then, the volatility can be calculated by (assuming the weights are all equal)

num_companies = len(companies)

# assign equal weights

weight = np.ones(num_companies) / num_companies

# convert to column vector

weight_vec = weight.reshape((-1, 1))

# volatility

volatility = np.sqrt(weight_vec.T @ np.cov(stock_returns.T) @ weight_vec)

volatility = volatility.item()

volatility

0.01823466003794474

def calc_volatility(stock_returns: pd.DataFrame, weight: np.ndarray) -> float:

# scale weights

weight = weight / weight.sum()

# convert to column vector

weight_vec = weight.reshape((-1, 1))

# volatility

volatility = np.sqrt(weight_vec.T @ np.cov(stock_returns.T) @ weight_vec)

volatility = volatility.item()

return volatility

Weighted Stock Returns#

For a certain portfolio, the weighted stock return is simply the sum of weighted returns of all invested stocks.

where \(r_i\) is the average stock return of the \(i\)-th company.

weighted_stock_return = np.dot(weight, stock_returns.mean().to_numpy())

weighted_stock_return

0.0005017068811196133

def calc_weighted_stock_return(stock_returns: pd.DataFrame, weight: np.ndarray) -> float:

# scale weights

weight = weight / weight.sum()

return np.dot(weight, stock_returns.mean().to_numpy())

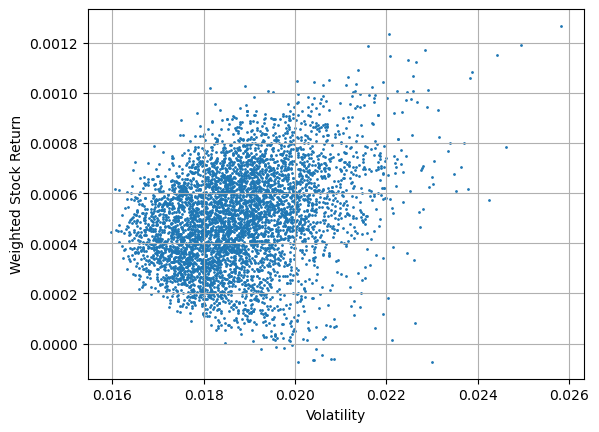

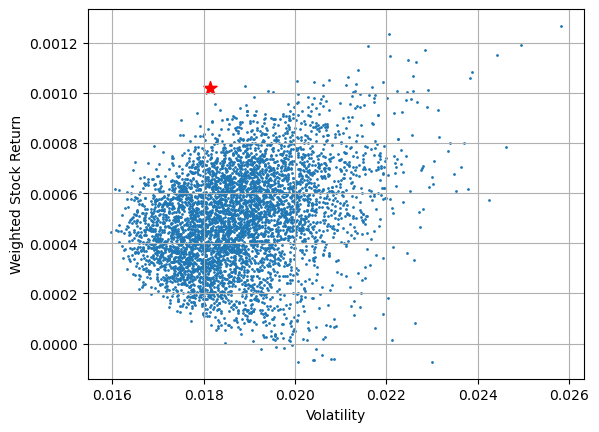

Monte Carlo Simulation#

We generate weight for each company is selected with equal probabilities and then calculate the stock return as well as the volatility.

# set seed

SEED = 7008

rng = np.random.RandomState(SEED)

# the weight for each company is selected with equal probabilities

m = 5000

simulated_weights = rng.random((m, num_companies))

from functools import partial

# calculate volatility for each portfolio

volatilities = np.apply_along_axis(

partial(calc_volatility, stock_returns),

axis=1,

arr=simulated_weights

)

# calculate stock return for each portfolio

weighted_stock_returns = np.apply_along_axis(

partial(calc_weighted_stock_return, stock_returns),

axis=1,

arr=simulated_weights

)

Plot the stock return against the volatility for each portfolio:

plt.scatter(volatilities, weighted_stock_returns, s=1)

plt.xlabel("Volatility")

plt.ylabel("Weighted Stock Return")

plt.grid()

plt.show()